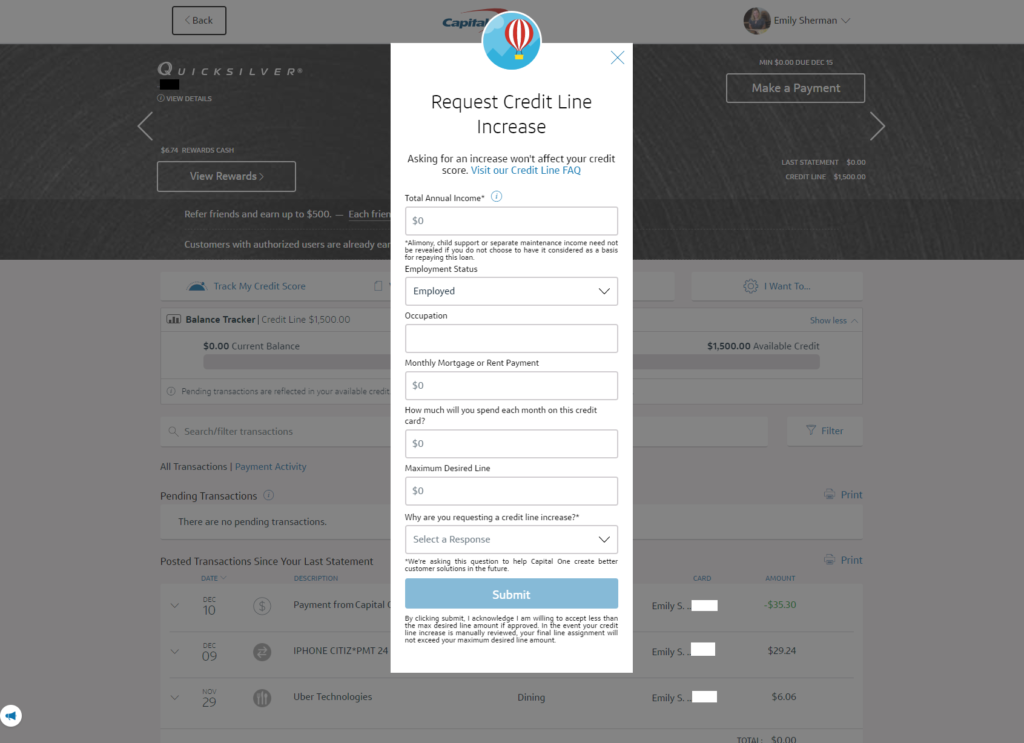

A hard inquiry from a credit limit increase request is a normal part of the process of applying for new or additional credit says john ganotis ceo of credit card insider.

Rooms to go credit limit increase.

This is a synchrony bank credit card.

A hard inquiry remains on your credit reports for approximately two years and may impact your credit scores for one year or more depending on the scoring model used.

Over a million locations.

See how a big purchase can fit your budget with manageable monthly payments.

75 or 5 of the total balance whichever is greater other fees.

180 day deferred interest period on all purchases minimum payment.

That day finally came and the br card is now our daily spender through the end of the year the problem though was that the card had a paltry 1 400 credit limit.

We offer flexible credit for purchases online and at our showroom kids patio and outlet stores in addition to a rooms to go credit card.

Equal monthly payments required for 60 months monthly payments shown are only applicable with this special financing offer.

See the credit options available from rooms to go online and store locations.

A while back i technically my wife got a banana republic credit card one of the many in synchrony s retail portfolio in the hope that i d one day get a really sweet promotion.

On purchases priced at 599 99 and up made with your rooms to go credit card through 10 12 20.

I was excited to get approved but it got slightly tricky afterwards.

Synchrony car care manage all your car expenses gas tires repairs and maintenance with one card.

Rooms to go credit card review.

Rooms to go requires a down payment equal to sales tax and delivery.

Smart features and free tools to help you get the most from your synchrony credit card.

Rooms to go requires a down payment equal to sales tax and delivery.

Synchrony will refuse every cli you request regardless of your credit rating on 2016 08 08 now that i think about this i have quite a few cards with them wal mart rooms to go american eagle and they have all came back and said on every card your request is above your credit limit policy for every card i have asked for a cli on.

I didnt realize this until i was at the outlet store about to check out.

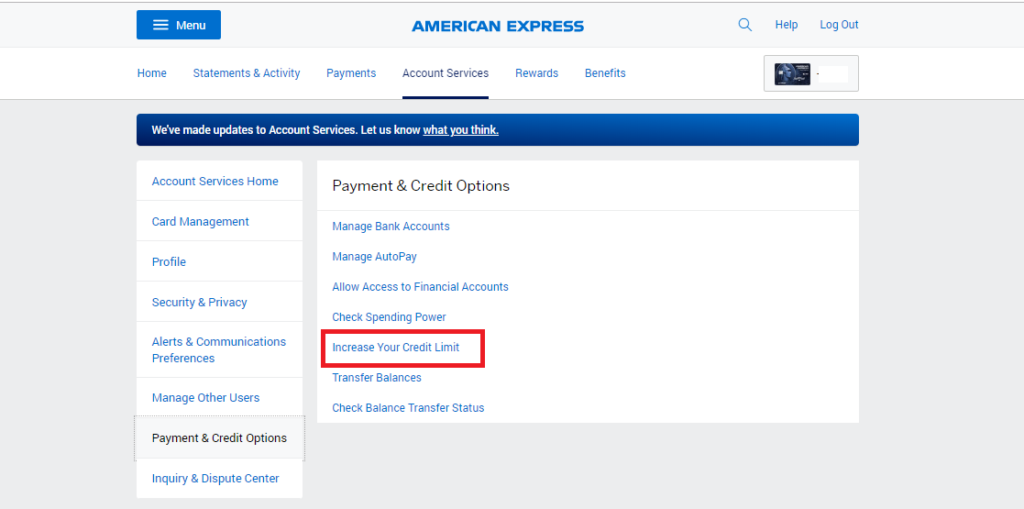

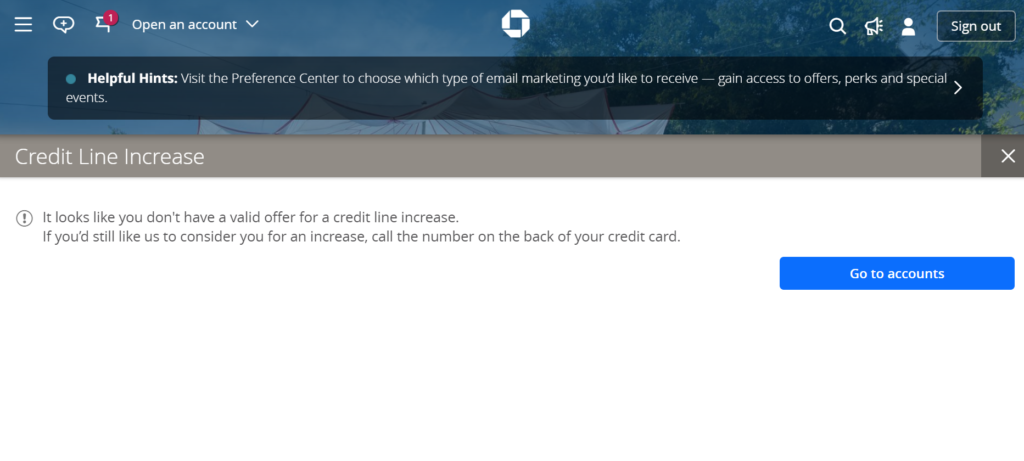

A higher credit limit gives you more purchasing power helps your credit utilization can help improve your credit score and can even help you qualify for credit cards with higher limits in the absence of an automatic credit limit increase from your credit card issuer you may request an increase many card issuers like chase allow you to apply online.

Here are some quick details about the rooms to go credit card.

Rooms to go outlet requires a down payment equal to 10 of your purchase sales tax and delivery.