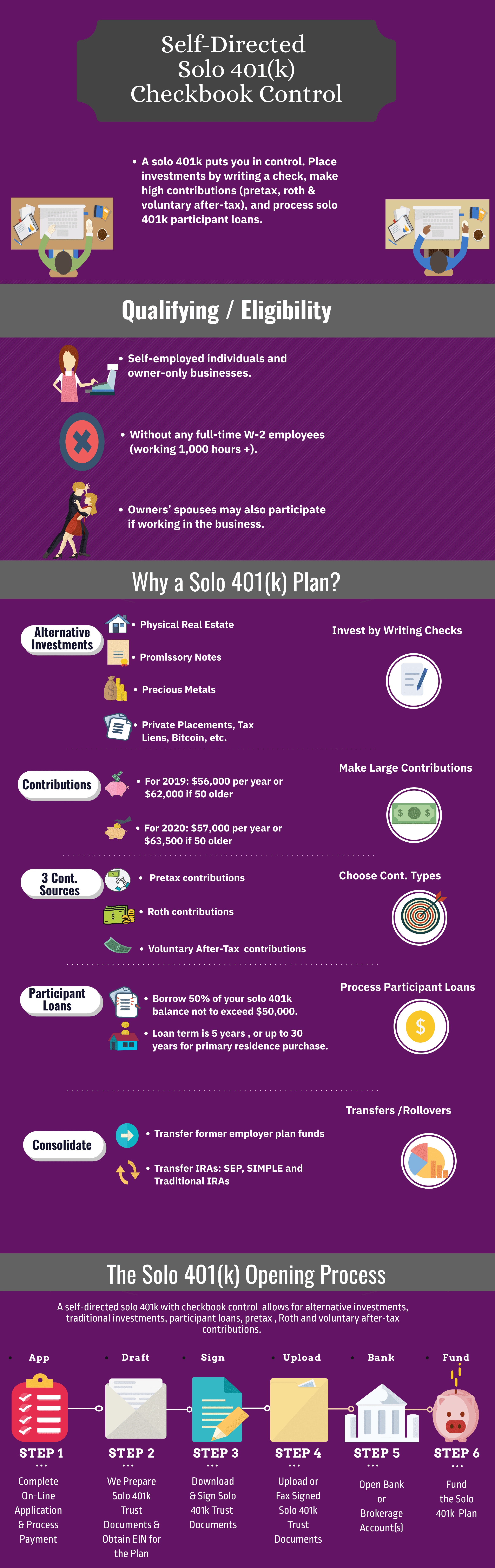

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Roll over 401k into sep ira.

The requirement for a person to reinvest a certain amount of money into their retirement fund after he or she previously requested and obtained a return on the deposits made to the.

Simple iras still may not accept rollovers from roth iras or designated roth accounts within 401 k plans.

Plus moving your money to an ira could help you.

You can choose either account to be the one to hold the combined assets.

Options for your old 401 k learn about rollovers and other choices for your old 401 k when you retire or change jobs.

For example if you perform a rollover from the 401k plan to the sep ira you could not perform another rollover from the 401k plan to any other retirement account for 12 months.

The rollover process allows participants to roll over money from a sep ira into a 401 k or vice versa.

Is a 401 k rollover right for you.

At its core a sep ira is just an ira and the same rollover and transfer rules apply to both.

Roll over your old 401k to an ira to gain investment flexibility without losing tax benefits.

Td ameritrade for example offers bonuses ranging from 100 to 2 500 when you roll over your 401 k to one of its iras depending on the amount.

In addition you could not roll over the money from the sep ira that you rolled the money into for 12 months.

Some of the top reasons to roll over your 401 k into an ira are more investment choices better communication lower fees and the potential to open a roth account.

Prior to 2016 a simple ira plan could only accept rollover contributions from another simple ira plan.

Give your money a fresh start by rolling it over into an ira.

What you gain from a 401 k rollover.

Roll to roth ira traditional ira simple ira sep ira governmental 457 b qualified plan1 pre tax 403 b pre tax designated roth account 401 k.